By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION likely accelerated in July but remained within the central bank’s 2-4% target range, analysts said.

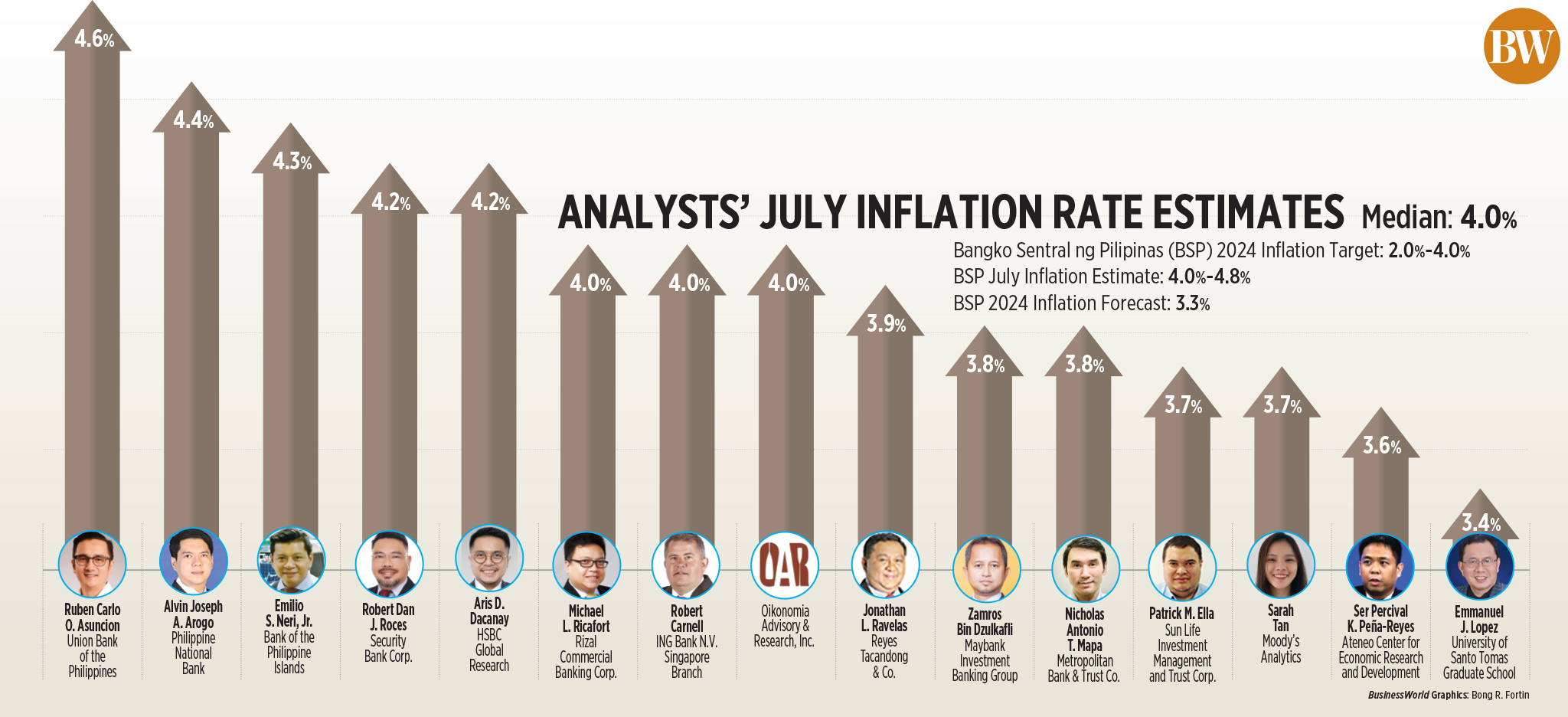

A BusinessWorld poll of 15 analysts this week yielded a median estimate of 4% for the consumer price index (CPI) in July. This matches the lower end of the 4%-4.8% forecast of the Bangko Sentral ng Pilipinas (BSP).

July inflation could be faster than 3.7% in June but slower than 4.7% a year earlier.

July could also mark the eighth straight month that inflation settled within the BSP’s 2-4% target.

The Philippine Statistics Authority (PSA) is set to release inflation data on Tuesday (Aug. 6).

BSP Governor Eli M. Remolona, Jr. told reporters late on Wednesday that inflation should have peaked in July, based on central bank projections.

Finance Secretary Ralph G. Recto separately said July inflation was expected to have accelerated though still within target.

“Coming from a low base, inflation will be higher, but still within target (2-4%),” he told reporters late Tuesday.

However, Mr. Remolona noted that the full impact of Super Typhoon Carina and the southwest monsoon would not yet be reflected in the July print.

“It won’t affect the July number. Usually, the effects come with a lag so it may not even affect August in terms of the aggregate CPI basket.”

Mr. Recto likewise said July inflation would be spared from the impact of typhoon losses. “Most likely, the impact will be seen in August. It won’t be in July.”

The latest data from the Agriculture department showed that agricultural damage due to the typhoon and southwest monsoon had hit P1.21 billion as of July 31. Rice was the most affected crop, accounting for more than half of the damage.

RISING FOOD PRICES

On the other hand, HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris D. Dacanay said there could be a “slight uptick” in food prices due to the typhoon’s impact on logistical costs.

Sarah Tan, an economist from Moody’s Analytics, said the immediate impact of the storm might not register yet in July but could still potentially stoke inflation.

“However, given that the typhoon destroyed crop harvests in agricultural provinces like Pampanga, where the agricultural damage reportedly totaled more than P300 million, the impact on food supply could add price pressures in the coming months,” she said in an e-mail.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said inflation likely accelerated to 4.6% due to higher prices of some food items, particularly vegetables, fruits and condiments.

Price pressures will also come from higher electricity rates, analysts said.

“Headline inflation may have also jumped month on month due to the steep increase in Metro Manila’s electricity rates after being deliberately kept low in June,” Mr. Dacanay said.

In July, Manila Electric Co. raised rates by P2.1496 per kilowatt-hour (kWh) to bring the overall rate for a typical household to P11.6012 per kWh.

“For July, higher electricity rates, elevated agricultural commodity prices and increased domestic oil costs drove inflation, and this was partially offset by lower rice and fruit prices, as well as the peso’s appreciation,” Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the stronger peso and the rollback in fuel prices could have offset inflationary pressures during the month.

Pump price adjustments stood at a net increase of P1.30 a liter for gasoline for the month of July. Diesel and kerosene had a net decrease of P0.90 and P1.70, respectively, per liter.

The potential breach of July inflation would be temporary, Mr. Roces said.

“Despite the recent typhoon’s possible, albeit transitory, impact on food prices, inflation is expected to return to target in August due to favorable base effects,” he said.

“Inflation is still expected to immediately return to within the 2-4% target band once base effects fade and then ease to the range of 2-3% once the lower tariff rates on rice eventually begin to bring rice prices down,” Mr. Dacanay added.

President Ferdinand R. Marcos, Jr. in June signed an executive order that slashed tariffs on rice imports to 15% from 35% until 2028. It is widely expected to bring down the retail price of rice.

Mr. Remolona said the tariff cut would “significantly moderate inflation” in the coming months. “That’s a good thing that will help us ease monetary policy.”

RATE CUT

The BSP chief again signaled cutting rates as early as this month. “I think Aug. 15 is still a possibility. Of course, it will depend on the numbers,” Mr. Remolona said.

He said they could cut possibly by 25 basis points (bps) at their Aug. 15 meeting, and by another 25 bps later in the year. The Monetary Board’s (MB) last two policy meetings for the year are scheduled for Oct. 17 and Dec. 19.

“Less hawkish is the term that we’ve been using. So, it’s still hawkish, which means we will still remain tight, but maybe less tight than before,” Mr. Remolona said.

“It’s a tricky thing because we’re so close to the point where we might be getting to below capacity. We want to reduce demand so that income falls just to the level of capacity of the economy,” he added.

On the other hand, analysts noted that the central bank could keep rates steady amid continued risks.

“Softer-than-expected inflation for July could prompt BSP to pull the trigger when the Monetary Board meets in August, but risks to food inflation and a weak peso could make them lean towards a rate hold,” Ms. Tan said.

“We maintain our expectation that the BSP is unlikely to leapfrog the Fed, keeping the policy rate at 6.5% in August,” she added.

Philippine National Bank economist Alvin Joseph A. Arogo said inflation breaching the target could derail the central bank’s planned rate cuts.

“Although supply side-driven, a breach of the 2-4% target inflation band of the BSP could complicate the timing of the forthcoming easing cycle,” he said in an e-mail.

Mr. Remolona said the BSP would also be taking into consideration the upcoming second-quarter gross domestic product (GDP) data, among other key data points.

The PSA is set to release second-quarter GDP data on Aug. 8.

“A weaker-than-expected second-quarter GDP print will more likely mean that the MB will start easing rather than remaining unchanged as the MB looks to longer-term economic growth prospects amid high borrowing costs,” Mr. Asuncion said.

Metropolitan Bank & Trust Co. Chief Economist Nicholas Antonio T. Mapa said the BSP’s anticipated easing cycle would “stimulate economic growth by encouraging new investments across various sectors.”

“As a result of all this, a potential resurgence in investment momentum is expected to accelerate GDP growth in the medium term, likely pushing it beyond the 6% pace of expansion and possibly even higher,” he said in a Wealth Insights report. “This increased investment activity is anticipated to have both immediate and long-term positive effects on the economy.”