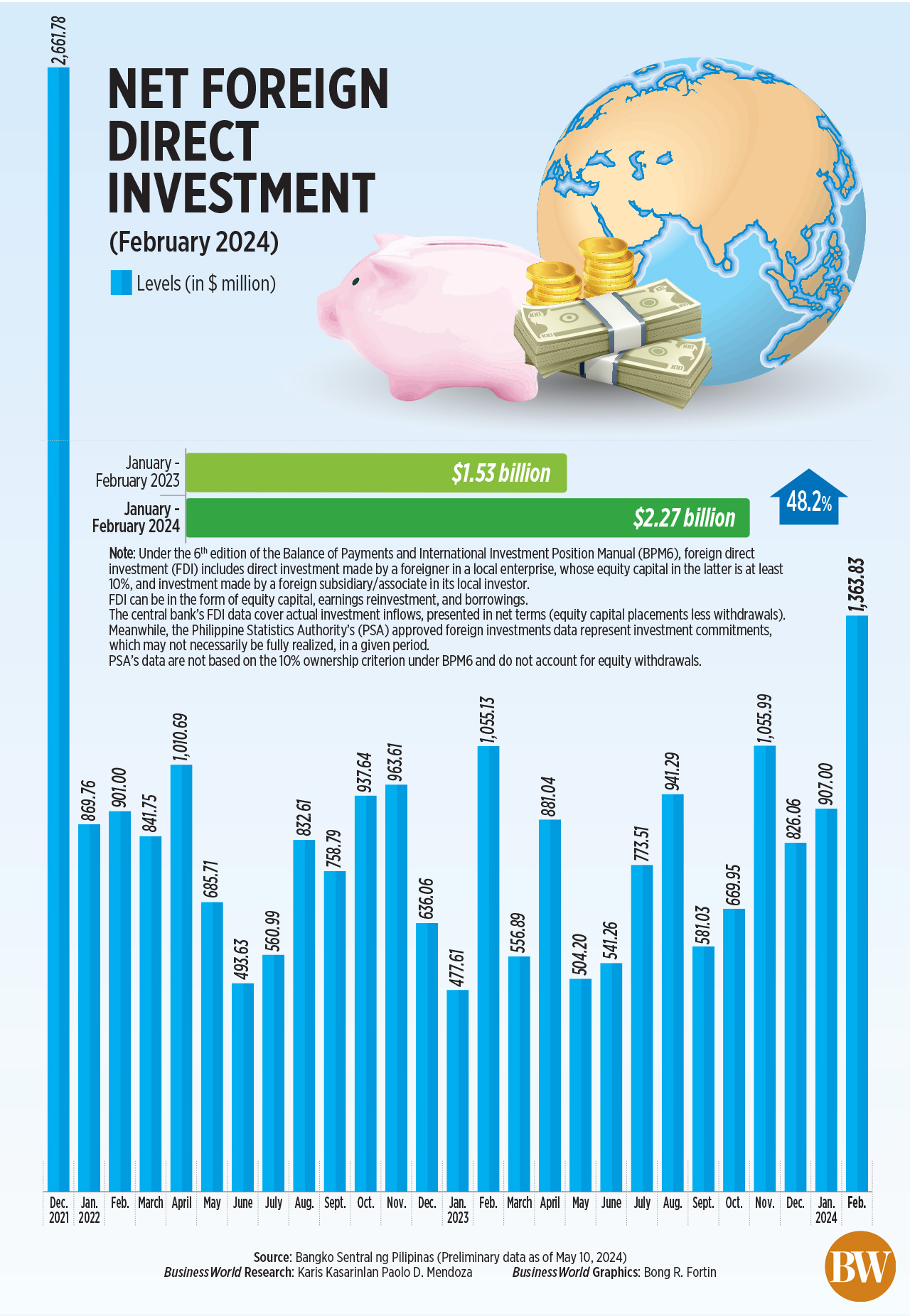

NET INFLOWS of foreign direct investment (FDI) in February soared to its highest level in over two years, data from the Philippine central bank showed.

Data from the Bangko Sentral ng Pilipinas (BSP) showed that FDI net inflows climbed by 29.3% to $1.364 billion in February from $1.055 billion in the same month a year ago.

This was its highest level in 26 months or since the $2.662-billion net inflows recorded in December 2021.

Month on month, FDI net inflows increased by 50% from $907 million in January.

Month on month, FDI net inflows increased by 50% from $907 million in January.

The BSP said this was mainly due to the expansion in nonresidents’ net investments in equity capital (other than reinvestment of earnings), which offset the decline in net investments in debt instruments.

Nonresidents’ net investments in equity capital (other than reinvestment of earnings) skyrocketed (927.3%) to $764 million from $74 million in the same month in 2023.

Broken down, equity capital withdrawals more than doubled (142.1%) to $93 million in February from $38 million a year ago, while placements surged (660.2%) to $857 million from $113 million a year ago.

The BSP said that the majority of equity placements in February came mainly from the Netherlands (89%). These were invested mostly in the financial and insurance industries.

On the other hand, nonresidents’ net investments in debt instruments of local affiliates plunged by 41.5% to $533 million in February from $912 million a year earlier.

BSP data also showed that investments in equity and investment fund shares ballooned (480.4%) to $830 million in February from $143 million year on year.

On the other hand, reinvestment of earnings slipped by 3.8% to $66 million from $69 million a year ago.

TWO-MONTH PERIOD

For the January-to-February period, total FDI net inflows rose by 48.2% to $2.271 billion from $1.533 billion last year.

Investments in equity capital other than reinvestment of earnings surged (350.3%) to $753 million in the first two months from $167 million a year ago.

Placements nearly tripled (265.7%) to $956 million while withdrawals more than doubled (115.5%) to $203 million.

Reinvestment of earnings went up by 7.4% to $165 million in the two-month period from $154 million in the same period a year ago.

Investments in debt instruments increased by 11.6% to $1.353 billion in the January-to-February period from $1.212 billion last year.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that the rise in FDI inflows can be attributed to the improved economic performance.

“Philippine economic growth is among the fastest in Asia… thereby encouraging more FDIs to come into the country amid favorable demographics and lower long-term interest rates that help boost investments globally,” he said in a Viber message.

The Philippine economy grew by 5.7% in the first quarter, faster than 5.5% in the previous quarter but slower than 6.4% in the first quarter of 2023.

The country’s growth is also about the same as Vietnam’s 5.66% and is ahead of China (5.3%), Indonesia (5.1%), Malaysia (3.9%), and Singapore (2.7%).

“Increased FDIs could have also partly been brought about by some realized investment commitments made for more than a year already during the various foreign trips of the administration,” Mr. Ricafort added.

The Department of Trade and Industry (DTI) earlier reported that President Ferdinand R. Marcos, Jr.’s foreign trips have generated $14.2 billion in actual investment, accounting for about 20% of investment pledges.

As of December, the President’s business travels generated pledges of $72.2 billion, the DTI said.

Mr. Ricafort said that possible rate cuts could help reduce borrowing costs and lead to more FDI inflows.

The BSP stood pat for a fourth straight meeting in April and kept its benchmark rate at a 17-year high of 6.5%. The Monetary Board will hold its next policy review on Thursday. The BSP expects to record FDI net inflows of $9 billion at end-2024. — Luisa Maria Jacinta C. Jocson