By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION accelerated to a nine-month high in July, mainly driven by a spike in electricity rates and food costs, data from the Philippine Statistics Authority (PSA) showed.

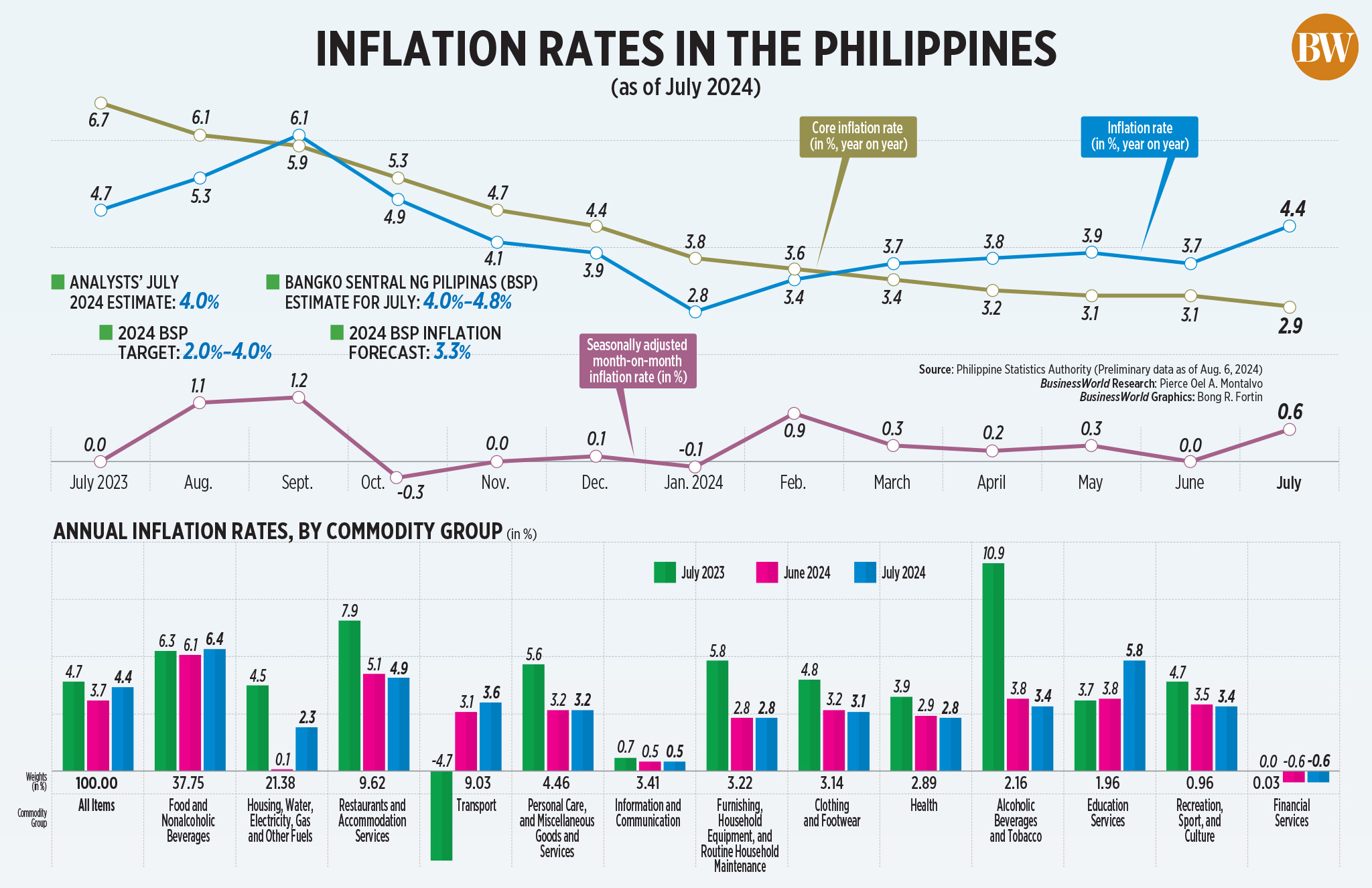

The consumer price index quickened to 4.4% year on year in July from 3.7% in June, falling within the Bangko Sentral ng Pilipinas’ (BSP) 4%-4.8% forecast.

It was higher than the 4% median estimate in a BusinessWorld poll of 15 analysts conducted last week.

The July print was also the fastest in nine months or since the 4.9% clip in October 2023.

July also ended seven straight months of inflation settling within the central bank’s 2-4% target band. Inflation had been within target from December 2023 to June 2024.

In the first seven months of the year, headline inflation averaged 3.7%, above the central bank’s 3.3% full-year forecast.

Core inflation, which excludes volatile prices of food and fuel, sharply eased to 2.9% in July from 6.7% a year ago. Core inflation averaged 3.3% in the first seven months.

“The latest inflation outturn is consistent with the BSP’s latest assessment that inflation will temporarily settle above the target range in July 2024 due mainly to higher electricity rates and positive base effects but will likely follow a general downtrend beginning in August 2024,” the central bank said in a statement.

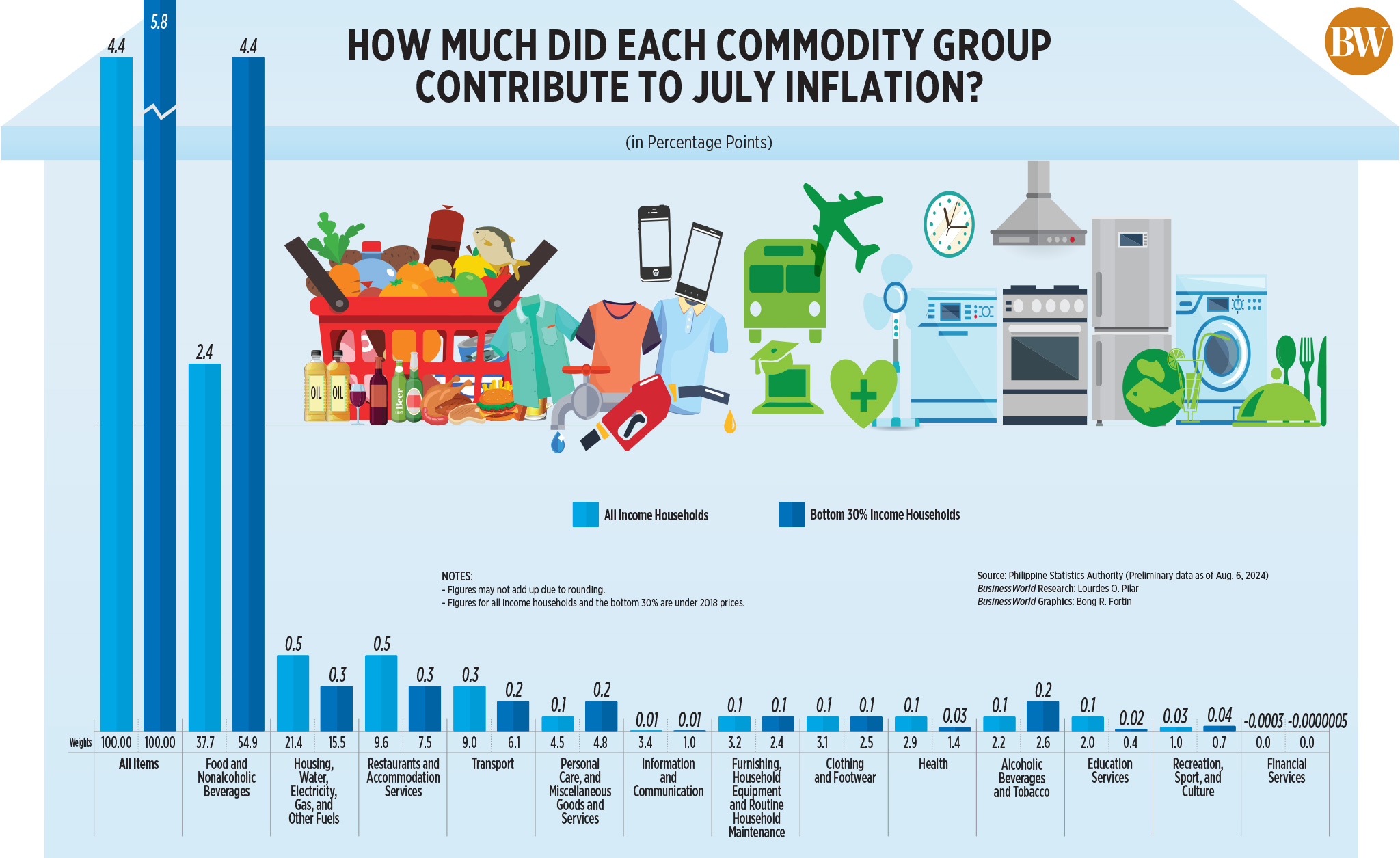

National Statistician Claire Dennis S. Mapa said that the main source of faster inflation in July was the housing, water, electricity, gas and other fuels index which rose to 2.3% in July from 0.1% in June.

“For power, we really expected that, because Meralco (Manila Electric Co.) adjusted rates in July. That’s where we saw a significant contribution to inflation,” Mr. Mapa said in mixed English and Filipino.

In July, Meralco raised rates by P2.1496 per kilowatt-hour (kWh) to bring the overall rate for a typical household to P11.6012 per kWh.

Inflation of liquefied petroleum gas (LPG) surged to 20.2% in July from 14.7% in the previous month, as LPG prices rose by P0.55 per kilogram.

Mr. Mapa also noted the heavily weighted food and non-alcoholic beverages index, which increased to 6.4% in July from 6.1% a month earlier and 6.3% a year ago.

Food inflation accelerated to 6.7% from 6.5% in June. This was primarily driven by faster prices in meat and other parts of slaughtered land animals (4.8% in July from 3.1% in June) and fruits and nuts (8.4% from 5.6%).

Meanwhile, rice inflation further eased to 20.9% in July from 22.5% a month prior, marking the fourth straight month of slower rice inflation.

PSA data showed that the average price of regular milled rice fell to P50.90 per kilogram in July from P51.10 in June; while well-milled rice declined to P55.85 per kilo from P55.96 in June.

While it is possible that Typhoon Carina hurt food prices in July, Mr. Mapa said its impact will be most likely reflected in August inflation.

“It’s possible that the impact of the storm has started, normally based on our historical data, prices of vegetables rise after a typhoon. That is the expectation we have, that this could rise in August.”

Agricultural damage due to Typhoon Carina and the southwest monsoon, which hit Metro Manila and nearby provinces in late July, stood at P3.04 billion.

Transport inflation was also one of the main drivers to the uptick in July inflation, Mr. Mapa said.

In July, transport inflation picked up to 3.6% from 3.1% a month ago.

“This increase was driven by increasing global petroleum prices due to the unexpected large withdrawals of United States gasoline stocks, optimistic fuel demand forecasts, and the ongoing geopolitical tension in the Middle East,” the National Economic and Development Authority said in a statement.

In July, pump price adjustments stood at a net increase of P1.30 a liter for gasoline. Diesel and kerosene had a net decrease of P0.90 and P1.70, respectively, per liter.

Meanwhile, the inflation rate for the bottom 30% of income households accelerated to 5.8% in July from 5.5% in June and 5.2% a year ago.

In the seven months to July, the inflation rate for the bottom 30% averaged 4.9%.

In the National Capital Region (NCR), inflation eased to 3.7% in July from 5.6% a year prior. Inflation in areas outside NCR averaged 4.6%, faster than 4.4% a year ago.

OUTLOOK

The BSP said that risks to the inflation outlook have shifted to the downside for this year and the next, primarily due to the tariff cut on rice imports.

President Ferdinand R. Marcos, Jr. in June signed an executive order which slashed tariffs on rice imports to 15% from 35% previously, until 2028.

“Nonetheless, higher prices of food items other than rice, as well as higher transport and electricity charges continue to pose upside risks to inflation,” the central bank added.

Finance Secretary Ralph G. Recto said that the uptick in July inflation is only temporary.

“Inflation rate is expected to stabilize and fall within target for the rest of the year as the impact of government interventions, particularly the reduced rice tariffs, will be more pronounced starting this August,” he said in a statement.

PSA’s Mr. Mapa said that rice inflation could continue to ease in the coming months, which would support slower headline inflation.

He said the reduction in tariffs on rice imports could “significantly” bring down rice prices in August. Rice inflation could possibly be slower than 20% in August, he added.

RATE CUT OFF THE TABLE?

The BSP said that it will consider the latest inflation data and upcoming second-quarter gross domestic product (GDP) data at its Aug. 15 meeting.

“Moving forward, the BSP will ensure that monetary policy settings remain in line with its primary mandate to safeguard price stability conducive to sustainable economic growth,” it said.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said that the “bigger-than-expected jump” in inflation may prompt the BSP to keep rates steady next week.

“In terms of the outlook for monetary policy, the July breach of the BSP’s target range, while well within the range of outcomes projected by the (central) bank, likely means that an August rate cut is now off the table,” he said in an e-mail note.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said in a report that the probability of a rate cut in August has declined as inflation breached the target band.

On Tuesday, BSP Governor Eli M. Remolona, Jr. said the central bank is “a little bit less likely” to ease rates at its August meeting as inflation was “slightly worse than expected.”

“It would be extremely odd for BSP to cut rates next week after this, though we don’t believe we will have to wait for too long before cuts are on their way,” ING Regional Head of Research for Asia-Pacific Robert Carnell said in a note.

Meanwhile, Mr. Neri said that the BSP’s easing cycle is still “on the horizon” amid easing core inflation and if second-quarter GDP data “significantly misses the forecasts.”

“A big upside miss to today’s figures could push back BSP aspirations to cut rates in August. But with the (peso) gaining some support as the USD weakens in the current market volatility, an August cut remains a possibility,” ING Bank said in a note.

Mr. Chanco said that 75 basis points (bps) worth of cuts is still possible this year amid expectations of the US Federal Reserve’s easing cycle beginning September.

“Accordingly, our revised base case for the BSP is a 25-bp cut in October, followed by a 50-bp in December. To be sure, if we’re right about a likely huge miss in Thursday’s second-quarter GDP report, then an August cut could come swiftly back into the discussion,” Mr. Chanco added.

Mr. Neri ruled out “aggressive” rate cuts in the coming months amid domestic and external headwinds.

“The BSP will likely prioritize domestic data in its policy decision on Aug. 15, but it may also consider global developments,” he said.

“Any signals from the Federal Reserve suggesting a substantial rate cut in September could increase the chances of a rate cut from the BSP in the next policy meeting.”

After Aug. 15, the Monetary Board’s remaining policy-setting meetings this year are on Oct. 17 and Dec. 19.